Eqvista entered the market with a bang, offering founders, investors, and other professionals an advanced and straightforward way to track and manage all their shares. Since then, the Cap Table app has been getting new features to make the lives of founders much easier. The latest addition is a free resource for founders in their online convertible note calculator.

If you are a new founder and have no idea about the different convertible note terms and how to use a convertible note calculator, this article will help you understand more about it and how Eqvista can help you!

Convertible Notes

A convertible note is a security instrument used by companies and investors. Using this instrument, an investor loans money to a startup in exchange for equity in the future when the company grows. This delay is because startups don’t have much value at first and would rather calculate the amount of equity the investor gets for the investment later. In short, the convertible notes are structured as loans that have the intention to convert into equity in the future.

So, when the milestone is reached, the loan is automatically converted to equity. And the conversion occurs at the valuation of a later funding round, that is, when the company has a higher value. Since this is a huge risk for investors, the company compensates them with additional clauses added to the convertible note, such as discounts and valuation caps. Some clauses also include an interest rate.

This is a great way to raise funding during the company’s initial stages as it does not force the founder or investor to value the company when it has no value. And when the time comes, you will need a convertible note calculator to get the final number of shares that the investor receives once the maturity date comes.

Convertible Note Terms

To help you understand how convertible notes work, you need to know about the different convertible note terms that make its clauses:

- Discount rate: Since the investor is taking a risk by investing in a company that might fail, they are offered a discount rate. The discount is on the share value that would be determined when the conversion takes place.

- Valuation Cap: This is a cap for the price at which the note will convert into equity. This clause offers investors ownership rights, like equity holders, and is exceptionally beneficial if the company is abruptly dissolved.

- Interest Rate: Ultimately, convertible notes are loans, and they do accrue interest. But the interest is paid in the form of shares when the conversion takes place.

- Maturity Date: This is a date set when the convertible note is issued. It is the date when the note would be converted, and the company has to repay the investor with equity.

Convertible Note Advantages

Convertible notes have a lot of advantages, which include:

- It is like a fixed income for the noteholders as the notes are loans that have interest rates and a valuation cap. Since the note converts into equity at a discount, the investor is sure to get gains in return.

- It is a low risk and efficient option for companies as it does not sell ownership. Moreover, both parties can skip the risk of valuing the company wrongly and avoid tax implications too.

- Since the issuance of convertible notes is normally done during the initial stage in a startup, it acts as a stepping stone for the company’s future valuation. It is an excellent pre-valuation investment.

- From the legal perspective, the convertible note documentation is relatively simpler, where the funding round can be closed quickly as compared to the usual equity funding rounds.

- Unlike common shareholders, investors with convertible notes do not get any voting rights. So the management does not have to worry about losing control over the company.

Eqvista Convertible Note Calculator

A convertible note document can be created easily with a combination of various clauses based on the agreement made between the issuer and the investor. The best way to have the document created is by using an app like Eqvista. Eqvista would not just handle the clauses for the deal; the Eqvista convertible note calculator would also help in the conversion of the note when the time comes.

How does Eqvista’s convertible note calculator help?

Calculations of the convertible notes into the company shares can be quite confusing. And if done wrong, it would become a huge headache. For instance, if the investor gets more shares, it would mean that they would get more ownership and return than what was agreed for in the deal. And if they get less than what the deal was, it could make them angry, and they can end up demanding more.

Converting the convertible notes into shares involves a lot of math and complex calculations. Due to this, it becomes highly stressful for the founders and the company to reach the outcome. Basically, getting the fully diluted cap table after the conversion becomes tough. That is where the Eqvista convertible note calculator comes into play. It would help you get the final outcome within seconds.

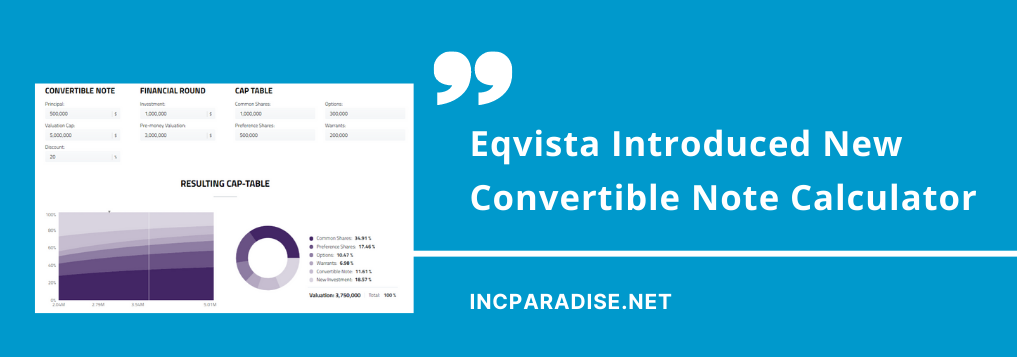

Let us take an example to understand better, while using the Eqvista convertible note calculator in this example. Assuming that you just opened your company and there are two main securities that your company has, including common shares and options. This is what the cap table would look like:

Common shares are given to the founders, while the options were given to the first employees as you did not have the money to pay them a high salary. But now you reach a point where you need capital to move ahead and make a place in the market. And since your company just started, determining its value for raising funds in exchange for equity would not be worth it. The best way to get funds is by offering a convertible note.

You find an investor who is ready to invest through convertible security, and you both negotiate and come to an agreement. With this, you end up getting an investment of $300,000 funding through a convertible note – SAFE. The investor gets a SAFE that is worth $300,000, a valuation cap of $2 million, and a discount of 10%. Keep in mind that did not add any interest rate to keep things simple.

Here is an overview of the SAFE convertible note as per the example:

Now, imagine that you and the investor would like to see how this convertible note would turn out to be later on, maybe before you even issue it. For this, you can use the convertible note calculator that is on Eqvista. To be able to do this, you will have to add the details to the calculator.

But, to do this, you need to have some other information as well. So, let us assume that the pre-valuation of the company is at $3,000,000 and the next investment round that takes place is of $1,000,000. With this information, you can now use the convertible note calculator to get the outcome. The convertible note calculator of Eqvista can be accessed through this link here!

Based on the example we have created here, we add in the details to the Eqvista convertible note calculator as shown below:

Once you add the details like the equity grants, convertible notes, new investment, and company valuation, you will be able to see how much company ownership each equity type has based on your company valuation.

Note: The graph (that is created using the convertible note calculator) would break down the total share ownership each one is and how your convertible notes are calculated into your company’s cap table.

From the above table, we can see that the common shares’ ownership which was at 52.63% before the convertible note was offered, has now changed to 35.49%. The ownership percentage of the options also changed from 47.37% to 31.94%. Since there were no preference shares and warrants, there wasn’t any change in the ownership percentage. The new investment now has an ownership percentage of 22.46% and the convertible holder now owns about 10.11% of the company after the conversion.

Here is a summary of how the Convertible Note and Investment round changed the company’s cap table.

In short, you can now easily use this FREE convertible note calculator on Eqvista to see where the ownerships stand after you have issued a convertible note or if you are about to issue a convertible note.

Create Convertible Notes on the Eqvista App

It’s also easy to create and issue convertible notes right on the Eqvista App. Once you begin using the app, you can get all the transactions done electronically. But before you can go ahead and issue a convertible note, you need to make your account. Check out the support article here on how to create a convertible note on Eqvista.

You can also take help and understand other parts and how to use it by checking out the support articles. If you are a new founder as well, we have created a knowledge center at the end of the support page shared above to help you become a better founder and stay ahead of all the rules and requirements.

Conclusion

Eqvista is a great application that every founder and investor should be using. It would not only help you in managing all the shares in your company but also control how to make your company grow. It also hosts financial tools like the waterfall analysis and round modeling, which show the breakdown of a company exit and also the ownership dilution when there is a new funding round.

So, if you are not yet using Eqvista, try it out today. In fact, if you are just about to open your company and offer convertible notes to your investors, then do that electronically through Eqvista. In the beginning, the application is FREE to use.