A founder starts off their career with just an idea, that is tirelessly worked on to form a business and earn a place in the market. But for an idea to grow, the founder needs hard work and the much needed capital to start, usually in exchange for company shares. And to manage a company’s shares and the various shareholders, a cap table is needed. A cap table helps in equity management in a company.

To explain better, a cap table is a list of all the information about who holds equity of the company and the rights to receive equity in the future. A cap table management system helps you in organizing the ownership stakes and outstanding securities in the company.

There are a lot of available equity management software applications in the market. But how do you choose the one right one for you? Let’s find out.

Equity Management

Offering investors, executives, founders, and employees equity is an investment in your company’s success. It is a great way to get capital that would help grow your company and increase its value. But as you will be giving out shares of your company, managing the equity of your company is very important. In fact, it is a very challenging task and needs to be handled properly using the right tools.

What is equity management in a company?

Equity management is the process of managing the owners, shareholders, and equity in your company. Although this sounds simple, it involves all the complexities involved with storing, tracking, documenting, analyzing, and reporting all the changes in the ownership of the company. You will have to update documents, communicate about updates to shareholders, consult the board of directors, and stay compliant with all the rules that govern issuing shares.

Why is equity management important?

Equity management takes place by using a cap table. A cap table offers you data that is laid out in a practical manner, allowing you to clearly see all the equity ownership of the company. It also shows all the liquidation rankings of the investors and the lenders who have invested in the business. And since most companies do not have traditional debt lenders, this list normally has the data of all the shareholders in the company and the percentage they own.

Even though equity has different forms, all of them impact the present and potential future investors. The cap table would help you make important decisions for the company’s capitalization, such as understanding the various possibilities to get the pre-money valuation faster. Or if you want to add another founder to the company, the cap table will help you see if there is stock available for the founder and how much percentage of ownership you can give the person.

In fact, a proper cap table can help the company attract investors and reduce the chances of diluting stakes as well. It would help potential investors in determining the amount of leverage and control that will be maintained in negotiations. By using equity management software, you will be able to share the real-time value of the stocks with the shareholders right from one place. It helps in forecasting future payouts for investors and the future potential dilution in specific circumstances.

In case there is an audit, your team would be able to show the holdings of the company easily when you have maintained a proper cap table with the right equity management software. In light of these things, cap table management is important for every company.

Factors Involved in Equity Management or Administration

There are a lot of things involved when it comes to equity management in a company. These things include:

- Issuing equity – The very first thing that the equity management helps with is the issuance of shares. For a company to issue shares, it has to know about the number of shares available, the price of the shares, and the amount of shares you can give to a person based on the amount of capital they invest.

- Cap table management – The cap table records the various securities of a company and who owns them. The more securities your company issues, the more complicated the cap table would be. This is when equity management is needed for issuing shares, processing exercises and transfers, updating the cap table after the funding round, and any other material event. The cap table would also have to be sent to all the shareholders in the company when updated.

- Shareholder management – One part of equity management includes updating the shareholders about the company’s finances and growth. This is because the more they know about your company, the more they will continue supporting and investing in it. But keeping all the shareholders in the loop requires the help of advanced technology. This can be taken care of with the help of the use of equity management software.

- 409a valuations – For issuing equity in your company, you will need to get an appraisal, called a 409A valuation, to qualify for IRS safe harbor. The 409A valuation gives the fair market value (FMV) of your common stock, which is the price of the stock. It is important to get a 409A valuation done every 12 months or whenever there is a material event like a funding round or a liquidation event. This is also something that is a part of the cap table management that has to be taken care of.

- Board management – The next vital part of equity management is board management. Just to be clear, before any securities can be issued in the company, the board’s approval is needed. In fact, the board’s approval is needed for every funding round and even when you want to hire a new executive. All of these processes also involve the sharing of sensitive documents, valuation reports and keeping the cap table updated.

- Maintaining Compliances – Other than the 409A valuation (which is a must to have when issuing shares), there are many other rules that the equity management admin has to take care of such as abiding to the Generally Accepted Accounting Principles (GAAP) when issuing and reporting equity. In the US, you will also have to follow the ASC 718, which is a set of accounting standards that outline the sets that the company takes when reporting employee stock-based compensation as income.

Moreover, if your company offers shares to international employees, then you will need to address International Financial Reporting Standards (IFRS) as well. Some additional rules include the Rule 701 and the $100 ISO limit. The equity administration also needs to trace the 83(b) elections to accurately withhold taxes.

Each of these parts have to be taken care of properly to manage your company equity. The best way to ensure all is done well is by using a proper equity management software. And there are many available in the market. One of the best one that you can use is Eqvista. What makes it great? The next section will help you with this.

Why use Eqvista for your company equity management?

When talking about the best equity management software in the market, the name that comes to mind is Eqvista. Eqvista is the sister company of IncParadise and is a leading cap table management and the 409A valuation provider.

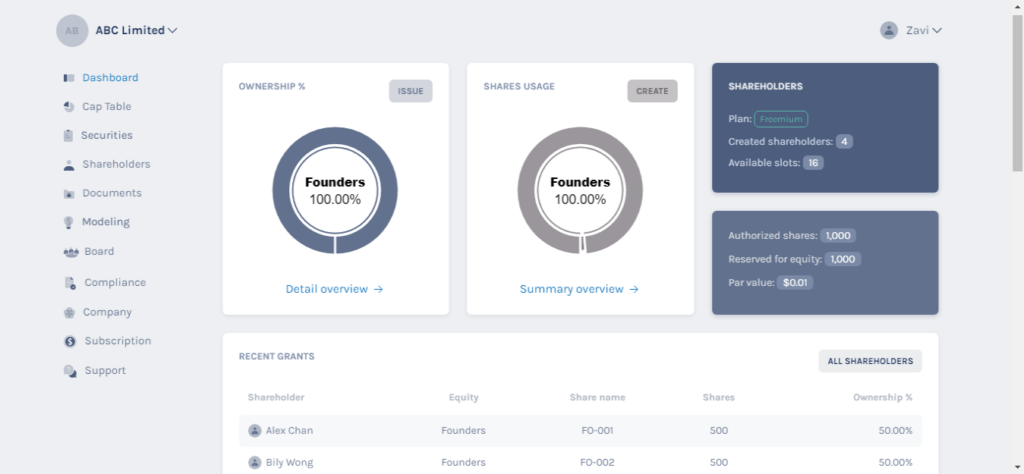

The app would be able to help you develop the most efficient cap table for your business. It has a very user-friendly approach that would help you reduce the time you normally would have spent on creating a cap table.

Here is what Eqvista has in store for you:

- Cap table management – You will be able to track and manage all the shares of your company right from one place. With Eqvista, you do not have to worry about incorrect cap tables as all the transactions are recorded and you can retrace your steps easily in case you made a wrong entry. It will help you save a lot of time and money.

- 409a valuation – They have a team of experts with years of experience in preparing 409A valuation reports for companies of any industry, size and stage. While preparing the report, they will guide you through every step and ensure that the final report is accurate, audit-ready and compliant. And since your cap table management is already done using Eqvista, getting your data would be seamless.

- Issue company shares – The platform is very easy to use and it allows you to directly issue electronic shares online without much trouble. With Eqvista, issue electronic shares to employees, investors, founders and more. All the things will be handled online from adding the vesting schedule to issuing the shares. And the best thing about this platform is that it is FREE to use for those with less than 20 shareholders.

- Support and training – For those who have just turned into a founder and do not know how to use Eqvista, they have numerous resources to equip you with the information you need. Learn all about being a great founder, cap tables, the related rules and even how to use Eqvista. They offer guides, blogs and the needed support and training for handling your cap table well.

- Benefit from Additional Features – Eqvista isn’t just a simple cap table management application. It has many other additional features, like their waterfall analysis and round modeling tools to help you see how the ownership will be diluted and what the payout for each investor would be. You can also use the board resolution feature to conduct shareholder voting and resolution acceptance all online!

In short, Eqvista is the go-to equity management software that you need for your business. So, while you are taking help from IncParadise to set up your business, make sure you are also working on your company’s cap table. Use Eqvista for this.

Learn more about Eqvista here! And to get your company incorporated in the US, contact us at IncParadise today!