In this business competitive world, every business entity tends to build a strong financial foundation. With an insight to manage all business expenses, capital acquisition, tax management and other financial matters for efficiently upscaling the growth and prosperity of the business, they are now hiring CFOs.

Therefore, the CFO’s Role is growing in every small and medium-sized business, which is to take care of all of the business numbers. Also, to hire a CFO or Chief Financial Officer is the most critical step toward an effective business growth strategy and a strong financial foundation.

CFO’s are responsible for providing precise information about the current and historical financial conditions, based on which the owners can predict future economic conditions of their business, and according to that, they can make the decisions, which are necessary for the business growth.

Effective decision making is a significant tool to drive business growth, and the CFO of a company helps in interpreting the results of cost control measures, social issues, government regulations and guidelines which impacts the decisions taken for economic growth of the business.

Do you also think that as a startup you cannot hire a CFO until you achieve a meaningful revenue? Then, you must be aware that this old rule does not apply anymore because the financial assistance will always be a fundamental requirement of a business growth strategy to support your long-term business goals:

Here are the key indicators and reasons which will tell you that when is the right time to hire a CFO for your Startup:

Internal Controls

The financial professionals or a Chief financial officer manages to control the internal overhead expenses and cash flows of the business. You can hire a CFO to establish credit policies for customers and to evaluate the optimal inventory levels.

CFO’s also tapped in the other internal controls like achieving favorable payment terms. Since it is very critical to choose or hire the right CFO for your company owner should head toward trustworthy CFO providers who can help you in finding a CFO after evaluating your business structure.

CFO’s for Projects Management

If you hire an effective CFO for projects management, they will surely go beyond executing and controlling systems of the company and put a significant financial impact. A CFO will do a qualitative as well as a quantitative analysis to develop an annual budget for the company.

You should even hire a CFO to handle the interactions with the CEO or owner of the company and with the managers to understand the capital investment requirements and fulfill them. Also, if you are facing conditions like having excessive expenses, dealing with the revenue generation or having a lot of other financial activities, then, a CFO can guide you through the whole management process, reducing your cost structure.

CFO -To Grow Relationships With The Financing Sources

The business entities hire a CFO to raise the fundings for their business. A professional Chief financial officer builds healthy relationships with the bank lines by negotiating proactively. Not only with the banks but a CFO considers approaching other financial institutions also in order to arrange the finances for the active operations of the company. A long-term business goal is to grow at a rapid pace and for that capital is required to be invested. A CFO can arrange seminars, conferences, or other formal and informal meetings for negotiating with investors to arrange this capital.

Major Strategic Issues

To hire a CFO is to expect the business strategies effectiveness, as a CFO provides a quantitative analysis of the numbers and assets management. Sometimes, the CFO takes part in the due diligence process of the respective business to decide either a merger or acquisition will be beneficial for the business in long-term or not.

Startups hire a CFO to fuel the additional growth of the product lines of their business, and for that, they arrange to have an extra investment from the public financial markets or an IPO (initial public offering ). So, major strategic issues are easily resolved by the tactics used by a CFO.

CFO – As Key Advisor

Do you want to have an adequate management strategy for your company? Then, it is the right time when you need to hire a CFO for your company or the new business venture. A professional CFO is a key advisor to the management team of your business or the company.

The financial wisdom of a CFO along with effective business knowledge helps the business entities to take critical decisions by providing accurate predictions for the future growth of your business. Also, if you hire a CFO, you can easily make a tangible connection or relationship between the business operations and the financial growth and requirements.

CFO – For formalizing a financial plan

Although, the major reasons have already been covered which indicates when to hire a CFO for your startup. But, this key point simplifies the aspect of hiring a professional chief financial officer.

If as a startup you want to raise the money internally and dramatically with the help of a unique financial model, then you must hire a CFO today. A CFO creates a financial model after studying the previous and current financial statistics, which is indeed very credible. A chief financial officer also integrates this financial model for your startup with the historical performance status and the sales activity after a precise projection for 3–5 years.

Conclusion

Every successful business entity keeps a continuous track of the key financial strategies, which will help them to grow their business. To keep up with the financial strategy, they hire a CFO (chief financial officer) at the right time i.e nor too early and not too late.

A CFO is thus a financial management expert who is a critical member of the management team to provide strategic advice with the long-term goals of building a company. The business entities should hire a CFO at the right time when the company starts to generate a bit of the revenue. Because a CFO can do the qualitative and quantitative analyses of the business numbers (financial) to bring effective advice to the CEO of the company, who can, therefore, take further important decisions (beneficial to grow a company) like key hires, expansions, product markets and much more.

To hire a CFO is like hiring an asset who will bring opportunities to grow your business. Since the CFO’s demands high salaries, the best way out for any startup is to provide them an equity compensation.

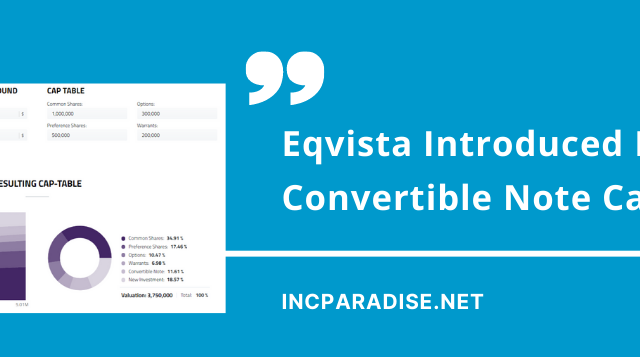

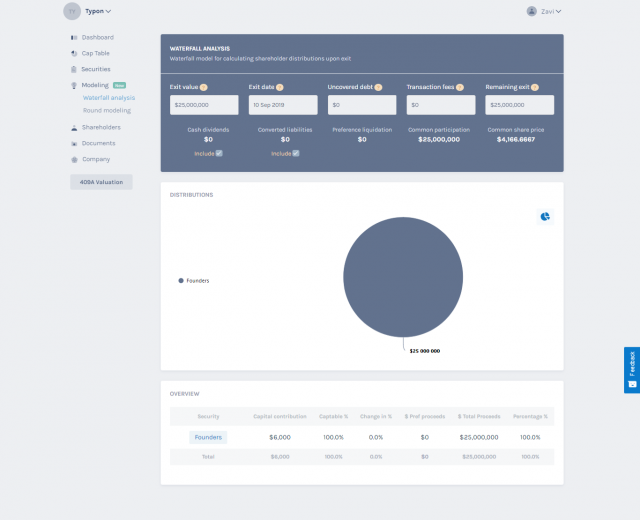

And when it comes to equity compensation, then you would need to offer shares to the person. This means that it would be your duty as the owner or founder to note down the shares that have been given out to the CFO. For this, you would need a cap table prepared. What is the best way to keep note of the shares other than a cap table application?

With the help of the cap table application, you would be able to add, manage and keep track of all the shares in the company. In short, you would need the application so that you do not end up losing the ownership of the company by not keeping a track of the shares given or purchased to others. Eqvista is the right one for you. With the cap table application – Eqvista, you would be able to manage and track all the shares easily.