Starting a business anywhere requires you to follow a set of rules. One such important rule is obtaining an Employer Identification Number (EIN). EIN can be termed as an identification number for businesses that have employees or file taxes as a corporation. If we look into the details of EIN then there are several pointers which need to be kept in mind before applying for an EIN. Such as, if you have a home business then having an EIN is generally not needed. But if you have employees in your home business, want to open a business bank account or want to apply for a credit card or loan then you might need an EIN.

Furthermore, if you have a home-based business then you might be confused whether you need an EIN or not. So don’t worry as this article will cover all your doubts and help you with getting an EIN easily. In this article, we will be learning about Employer Identification Number (EIN) in detail. What is an EIN, why it is needed for home businesses, what are its benefits, what are the reasons and how to get an EIN for business. Be with us till the end so that you don’t miss any important step or information.

What is an EIN and Why Might My Home Business Need One?

The term EIN stands for Employer Identification Number. An EIN is a nine-digit number which is assigned to businesses by the Internal Revenue Service. It is a unique number which is given to businesses that have one or more than one employee in their company. An EIN is also known as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN). An EIN has several uses including federal tax reporting, business licenses, contracts, business account opening, etc.

Understanding the Difference Between SSN and EIN

A common topic of discussion is the similarities between Social Security Number (SSN) and Employer Identification Number (EIN). We can also say that the EIN works as a social security number for businesses. Both of them are used for similar kinds of purposes such as filing federal and state taxes, identification, banking, hiring employees and compliance. If we look at the basics such as the number of digits then it may seem like both are the same. However, both of them are different from each other. A social security number has the format xxx-xx-xxxx while the employer identification number has the format xx-xxxxxxx. Moreover, a social security number is used by an individual for different activities while an employer identification number is used by a business entity for various purposes.

LLCs vs Sole Proprietorships: When Is an EIN Required?

LLCs and sole proprietorships are two of the most common types of business entities. Limited Liability Companies or LLCs are a separate legal entity from its owners. An LLC owner is not liable for the debts and liabilities of the business protecting the personal assets of the owner. On the other hand, sole proprietorship is the most common type of business structure in which there is no distinction between the owner and the business. So now that you have understood both types of business structures, you must know whether you need an EIN for your business or not. If your business is a corporation or a partnership then you are required to have a home business EIN. The following are some more situations in which having an EIN is mandatory.

- You have employees.

- Your organization is tax-exempt

- You have a Keogh plan or a solo 401(k) retirement plan.

- You choose to file taxes as a corporation.

- You inherited your business.

- You bought your business.

- You file for bankruptcy.

Beyond the Basics: Additional Benefits of Obtaining an EIN for Your Home Business

Having an EIN for your home business can prove to be highly beneficial for you. Apart from filing taxes and identification, it also helps in several other tasks. The first and foremost benefit of having an EIN for your home business is you can manage your business and personal finances separately. By using your EIN, you open a business bank account and keep your finances separate. This can help you manage your funds more efficiently and make tax filing easy. Moreover, having an EIN protects your SSN and reduces the chances of identity theft and leakage of personal details.

The EIN of your home business plays a vital role in building credibility while opening business bank accounts or applying for credit cards and loans. It establishes your business as a legitimate entity and showcases your professional image in the market. Overall, an EIN builds a positive reputation for your business and helps you secure finances for business operations easily.

Apart from these benefits, EIN is required in several states for multiple business licenses and permits. Some examples include California, Florida and Texas. EIN is required in California to obtain sales tax permits from the California Department of Tax and Fee Administration. It is also needed to register for payroll taxes with the Employment Development Department. Just like in California, it is mandatory for businesses that are paying their employees to have an EIN for reporting and paying payroll taxes. In Texas, EIN is required to obtain a Texas Sales and Use Tax Permit and for registration in the accounts of the Texas Workforce Commission.

Obtaining Your EIN: A Quick and Easy Process

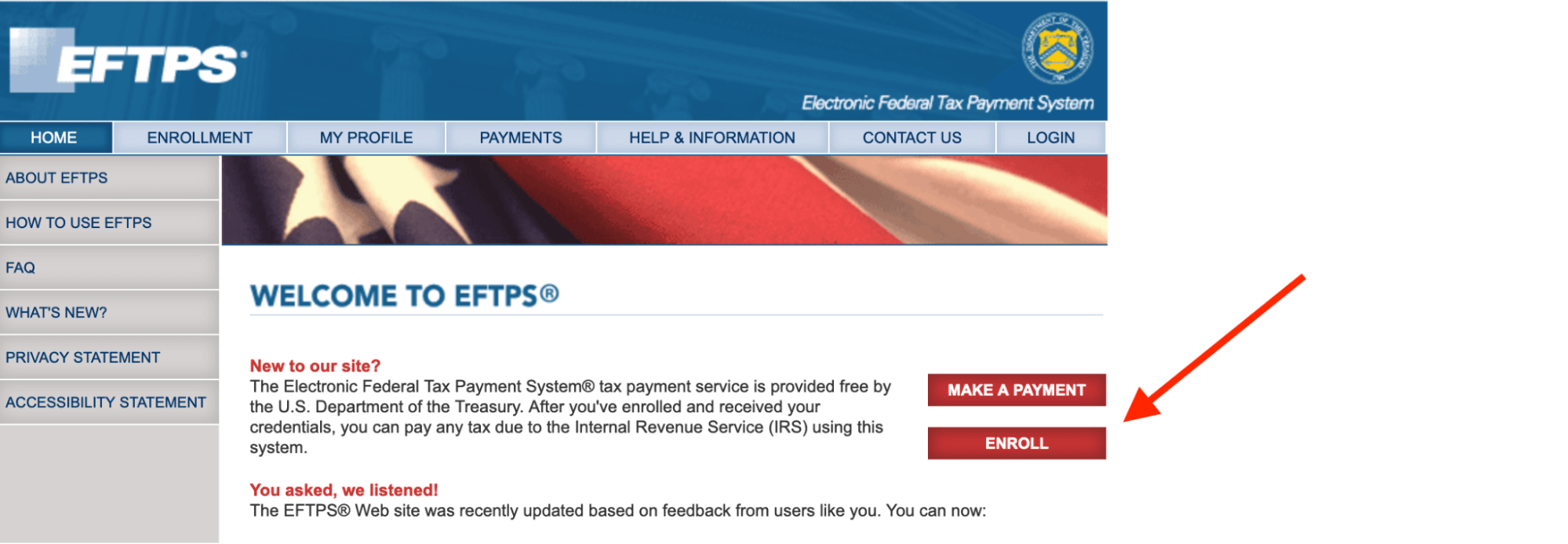

Obtaining an EIN is a very easy and hassle-free process. There are several ways to apply for an Employer Identification Number. You may choose to get your EIN by phone, fax, online, or through the mail. The process is quick and straightforward—simply follow a few easy steps to obtain an EIN for your home business.

- Visit the IRS website and click on ‘Apply for an EIN Online’. After this, you need to click on ‘Begin Application’.

- After starting the application, you are required to select your business structure. Your home-based business’s business structure would most likely be a sole proprietorship. However, if you have a partnership or choose to be identified as a corporation or an LLC then you must choose that.

- Then you are needed to fill in your details such as your name, Social Security Number, address and phone number.

- After you have filled in all the details of your business and yourself, you will need to choose the type in which you want your EIN to be delivered. You can either get it instantly as a PDF, through fax, or on the phone, or you can get it through mail, which would take around four weeks.

If want to obtain your EIN more easily then you must get the EIN services of IncParadise. By getting the special EIN services of IncParadise, you can make the process extremely smooth. As IncParadise will be applying on your behalf, it will save you valuable time and protect you from mental stress. IncParadise offers full EIN service at a highly reasonable cost of $45. IncParadise is one of the most reputed agents in the country that can help you get your EIN within the shortest processing time possible.

Get Your EIN Today: Streamline Your Home Business

If you run a home-based business and are uncertain about whether you need an EIN, this article will clear things up. It answers common questions and explains the main benefits of getting an Employer Identification Number. An EIN is essential for businesses that hire employees, open business bank accounts, or apply for credit cards and loans, among other purposes. The process to obtain an EIN is pretty simple if you follow all the steps correctly. However, if you don’t want to make any mistakes in the process then you must hire a professional to do the work and this professional is IncParadise. You can get help from IncParadise to obtain your EIN and be safe from any mistakes in the process.