The Employer Identification Number (EIN), Social Security Number (SSN), and Individual Taxpayer Identification Number (ITIN) – EIN vs SSN vs ITIN are very different from each other. They are all tax identification numbers (TIN) but are not the same. TIN is used for tax purposes in the USA. As per the Internal Revenue Service (IRS), you need to apply for these numbers before you can file for your tax return and get all the benefits. These numbers are asked by many other institutions like the bank and so on.

So, these numbers act as your tax ID. Nevertheless, there are different laws for enterprises, entities, individuals, and workers, which is why you need to know the exact purpose of the EIN vs SSN vs ITIN. This article will help you understand the difference between EIN and ITIN and SSN. Keep reading!

EIN vs SSN vs ITIN

When it comes to EIN vs SSN vs ITIN, there are some main differences that need to be understood. To begin with, the EIN is like an SSN for a business. But those businesses that are running as a sole proprietorship do not need an EIN and can just use their SSN instead for that purpose. On the other hand, the ITIN is different from the EIN vs SSN. It is for those people who are non-residents and do business in the US. These people have to get the ITIN to file for the taxes in the USA. Let us talk about each in detail to understand them properly.

EIN or Employee Identification Number

Employer Identification Number acts as the social security number for the businesses. But just to be clear, it is not needed by all businesses. For instance, the single-member LLC and sole proprietors do not legally require you to get the EIN. Only the companies that are hiring employees need to get the EIN. Here is all you need to know about it.

What is an EIN?

Employer Identification Number, the EIN, is also known as the Federal Employer Identification Number (FEIN), or the Federal Tax ID Number. It is a nine-digital number that is issued by the Internal Revenue Service (IRS). It has the format of XX-XXXXXXX. This number is used by the IRS to identify a business entity and apply the suitable tax laws for it. In short, it is like the Social Security Number, just that it is for a business.

Obtaining the EIN is important for every company that is operating in the USA. As soon as the company gets its EIN, it stays the same, until:

- Partnerships: If partnerships incorporate, end an old partnership and start a new one, or if one of the partners takes over the partnership and operates it as a sole proprietorship.

- LLCs: Since the IRS did not create a new tax classification for the LLCs, they have different rules. You can learn more about them here!

- Sole Proprietors: If you incorporate, inherit/purchase an existing business that you operate as a sole proprietorship, switch to a partnership, and if you are subjected to bankruptcy proceeding

- Corporations: after a statutory merger creates a new corporation, after changing into a sole proprietorship/partnership, becoming a subsidiary of a corporation using the parent’s EIN, becoming a subsidiary of a corporation, upon getting a new charter from the secretary of state

- Trusts: if one person is the maker/grantor of “many trusts”, or if trusts changes to an estate, a living trust terminates by distributing its property to a residual trust, an inter-vivos/ living trust shifts to a testamentary trust

- Estates: If a trust is created with the estate funds, or if you represent an estate that operates after the death of the owner.

Along with this, the following entities also have to get the EIN:

- Nonprofit organization: They need it to apply for the tax exemption and it is also used by the donors to report the donations made.

- Personal service corporations: Any owner that is performing personal services in the field of the performing arts, actuarial science, architecture, engineering, consulting, accounting, law, health

- Household employers: Any person hiring someone to help in their homes and the agents acting on their behalf

- Real estate mortgage investment conduits (REMICs): they are treated as partnerships by the IRS.

- Individuals filing for bankruptcy – under Chapter 11 or Chapter 7 of the US Bankruptcy Code.

- Employee benefit plans

Note: If any third-party handles your taxes, they too need to have their own tax identification number.

It is important to note that your EIN cannot be canceled, expire or be assigned to someone else, even when the entity ceases to exist. All you need to do is contact the IRS when you are closing your business, to close the EIN account associated with it. To do this, you need to send a letter that has the legal name of your business, the address, EIN and why you are closing the account.

Why does a business owner need EIN?

There are many uses for the EIN for businesses. Here are some of benefits that you get from using it:

- Hiring employees: This is one of the main reasons why you need to get an EIN. LLCs too, even if they are not hiring any employee initially need the EIN since as soon as they are incorporated, you are considered to be an employee.

- Opening a bank account: If you are about to open a business bank account in the USA, you will need your company’s EIN for it.

- If you change your organization type: Like if you are changing from a single-member LLC to a member-managed LLC, you need to get the EIN. If you already had one, then you will have to fill the Form 8832 so that it can help you retain the EIN.

- If you want to establish business credit: Business credit is different from the person credit and would be based on your business’ spending history and the EIN.

- Filing employment, tobacco, alcohol, excise, or firearm taxes.

- Establishing retirement plans, profit sharing and pension: If you want to create these plans, you will need the EIN as you will be considered to be the plan administrator.

How to obtain EIN?

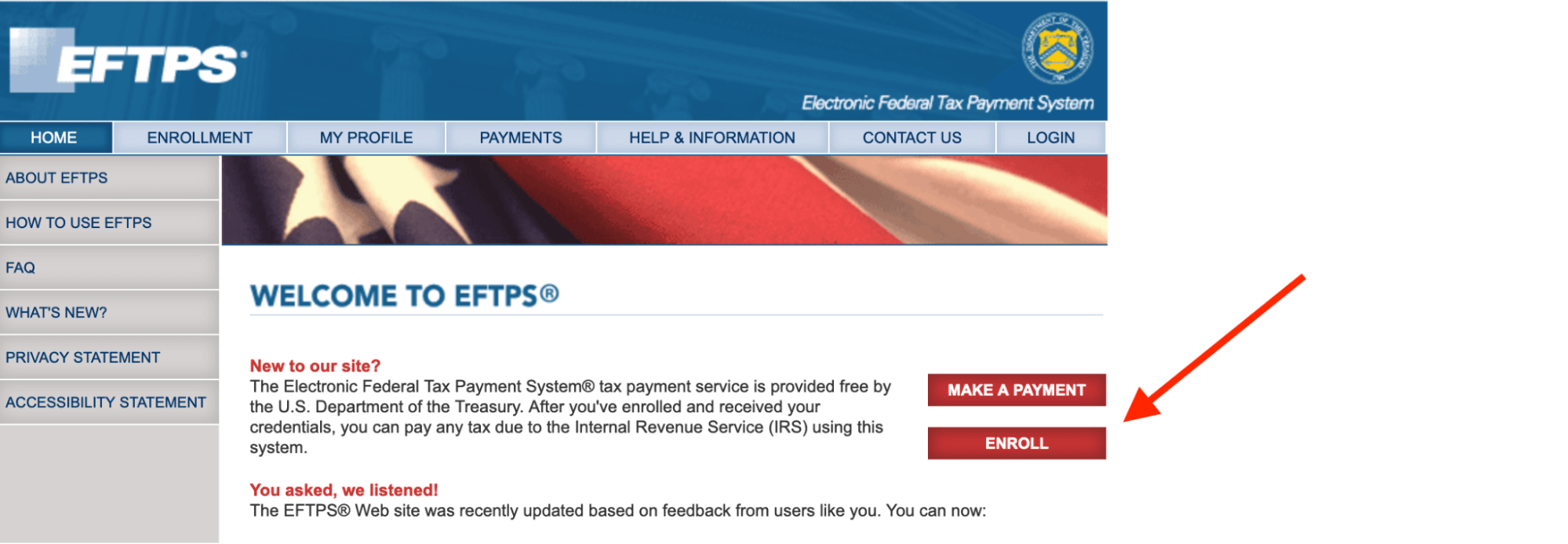

It is easy to apply for an EIN online, by fax, by mail or even by your phone with no IRS charge at all. Every EIN application has to share their taxpayer identification number (SSN or ITIN) and their name in the form. This person or entity is considered as the “responsible party” as per the IRS. For applying online, visit the IRS website. As soon as you complete the application, the information is validated in the online session and you will get the EIN instantly.

If you apply by mail, it would take you longer. For this, you will have to file the Form SS-4. By phone, you can apply by calling the number 267-941-1099. Note that this is not a toll free number and you can only call them between 6:00 am to 11:00 pm ET from Monday to Friday.

SSN or Social Security Number

The Social Security Number (SSN) is a tax identification number (TIN) that all US residents and lawful aliens need to have to get payments, salaries, and use plenty of vital services. It is the only TIN issued by the Social Security Administration. Let us understand more about this to understand the difference between EIN vs SSN vs ITIN.

What is an SSN?

Social Security Number (SSN) is a nine-digit number that has the format of XXX-XX-XXXX. It is assigned to all the permanent residents and US citizens. Any person who works in the US, or has the right to work in the US, regardless of the employment type, has to have the SSN so that they can get their salaries or self-employed payments.

Apart from getting a job and being paid, people need the SSN for:

- Registering to vote

- Applying for Earned Income Tax Credit (EITC)

- Collecting Social Security benefits

- Taking loans

- Opening their individual bank accounts

- Registering their motor vehicles

- Using other government services

It is crucial to note that anyone, with any immigration status can get the SSN. You just need to be a legal and lawful alien in the country. The SSN is written on the Social Security Card you get after you apply for it. And even though you just need the number memorized, it is always good to keep the card safe.

Why need an SSN?

The SSN is important to get you hired for a job or get any sort of payment. It also helps you in obtaining your driver’s license. But what does the SSN do for small business owners? Well, here is how the SSN helps a business owner:

- Filing annual tax returns: You can use your SSN or EIN when filing for your business tax returns (it is mostly based on the type of entity you own and has been explained above for EIN).

- Federal loan applications: A lot of entrepreneurs look for federal loans for extra-small business funding. This TIN can help in getting a credit check and determining the eligibility to get the federal loan.

- Opening bank accounts: This is a main requirement for every personal and small business bank account in the US. For businesses, you will also need your EIN to open the bank account.

The USA residents usually do not need to worry about getting the SSN since they would already have got one from the SSA. All they need to do is safeguard this number. And if you have a business, then the next thing you need to get is the EIN.

How to get an SSN?

To get the SSN, you will need to fill out the Form SS-5, which is the application for a Social Security Card that would come with the SSN. It is free to apply for this TIN and you will not have to pay any fee to the IRS for it. You can also get it by calling 1-800-722-1213 or by visiting your local Social Security office. To get the SSN, you will have to submit evidence of your age, identity, and US citizenship or lawful alien status.

ITIN or Individual Taxpayer Identification Number

The Individual Taxpayer Identification Number (ITIN) is issued by the IRS to the people who are not able to obtain the SSN but have to report taxes. ITIN, unlike the EIN and SSN, can expire and has to be renewed. Let us understand more about this.

What is an ITIN?

The Individual Taxpayer Identification Number (ITIN) is a number that is issued by the IRS. They use it to denote the non-residents for federal tax reporting. ITIN looks a lot like the SSN, but the ITIN always has 9 as the first digit – example – 9XX-XX-XXXX. Basically, this TIN is given to those people who do not have the rights to get the SSN but need some US TIN. These people usually include the non-resident aliens, people with temporary visas, and those people who might have a US filing or reporting requirement under the IRC (Internal Revenue Code).

To be more precise, the people who need the ITIN include:

- People who need to have a TIN or file a federal tax return and are:

- Non-resident alien professors, researchers, or students filing a US tax return or claiming an exception

- Non-resident aliens claiming tax treaty benefits

- Spouse of US resident aliens/citizens/non-resident alien visa holders, or dependent on them

- Non-resident aliens/US resident aliens

- People who are not eligible to obtain an SSN

It should be kept in mind that getting the ITIN does not mean that the person is allowed to work in the US. It also doesn’t mean that the person is qualified to be a dependent for Earned Income Tax Credit, can be granted the SSN eligibility, or get the Social Security benefits. If your SSN application is pending, you would not be able to get the ITIN as you can only have one of those.

Why do you need an ITIN?

The ITIN has a few purposes, where most of them are related to compliance and the US tax laws. As per the IRS, the things that a person cannot do with an ITIN include:

- You will not be eligible for social security benefits just because you have an ITIN.

- Having an ITIN does not mean you can work in the US.

So, the real purpose of the ITIN is that it gives entrepreneurs the option for federal tax reporting. These numbers do not have any other purpose for the business owners. This is still an important function for making sure that your US tax returns have been filed. So, if you know you need the ITIN, then it is important to get it quickly.

How to obtain ITIN?

To get the ITIN, you will have to complete the Form W-7 to submit to the IRS. the W-7 would need you to give documents that show your foreign/alien status and the true identity for each individual. All these documents can be mailed to the address on the Form W-7. You can also give it by hand by walking into the IRS walk-in offices or process your application via an Acceptance Agent that is authorized by the IRS. Acceptance agents are entities that are authorized by the IRS to assist applicants in getting their ITINs.

Major Differences between EIN, SSN and ITIN

So, to put all that we have learnt about the EIN vs SSN vs ITIN in a nutshell:

- EIN is like the SSN but for businesses where single-member LLCs and sole proprietors don’t need to get it. To obtain the EIN, you need to fill the Form SS-4.

- SSN is legally required by all US citizens and lawful aliens to get payments, salaries and use a lot of other services in the country. To get this, you fill the Form SS-5.

- ITIN is for those who cannot get the SSN but have to report their taxes. To get this, you need to file the Form W-7.

Now, let us get into the comparison and find the difference between EIN vs SSN vs ITIN in detail.

ITIN vs SSN

SSN is for the US citizens/legal aliens/permanent residents, while the ITIN is for the non-residents. Both the SSN and ITIN are mutually exclusive. This means that you can have just one out of the two. So, if you are not eligible for the SSN, then ITIN is the one for you. If you get the SSN while the ITIN application lasts, the ITIN application would be terminated.

ITIN vs EIN

Other than the fact that the both are TINs, these two do not have a lot of things in common. ITIN is for individuals, while the EIN is for businesses. To be more precise, ITIN and SSN are for personal taxes, while the EIN are for business taxes.

EIN vs SSN

Both EIN and SSN never expire and remain for a lifetime. So, this means that you do not need to renew them. EIN stays connected with the business even if the business ceases to exist, while the SSN always remains to be a part of your personal documentation. But these two are not the same. SSN is for personal use, while the EIN is for people who pay or employ other people for business services. So, you can get an EIN without having an SSN. You will only have to mention if you have an ITIN in the form SS-4 on the line 7B, where you need to write “ITIN” if you do, and “Foreign” if you don’t.

Can you use an EIN instead of an SSN?

Yes, you can. In fact, there are some cases where you are highly recommended to use the EIN instead of the SSN. For instance, the freelancers, sole proprietors, and single-member LLCs who do not hire anyone else can use their SSN for taxes. Nonetheless, EIN is public information and SSN is a private one due to safety purposes. This is why it is better to use an EIN in these cases too, along with your SSN.

In fact, here are some reasons why you should use your EIN instead of your SSN:

- Guarding your privacy

- Appearing more professional in the eyes of institutions and your clients

- Separating personal finances from business finances

At the end of the day, if you are a business owner, it is important for you to obtain the EIN.

Need Any Assistance in Obtaining EIN for Your Business?

If you need some help to obtain the EIN for your business, then IncParadise can help you with it. The team would not just help you get this, they can also help you with many other things like opening a bank account, mail forwarding, and so on. In fact, if you have not yet started your business, we can help you with the registration and incorporation of your business. To know more, contact us today!