We partner with Cheqly and can assist their clients with all their EIN filing needs. To make things easier, We’ve created a guide that helps you verify your EIN if the IRS only reports it to you over the phone without any paper confirmation, which is necessary for opening a Cheqly account. Before starting this process, We assume you have an EIN given by the IRS and If you don’t have an EIN yet, don’t worry, you can order this service from us. This process helps you get proof of your EIN from EFTPS, which is required for compliance purposes.

You will need to receive:

- Filled Application in PDF

- Confirmation document in PDF

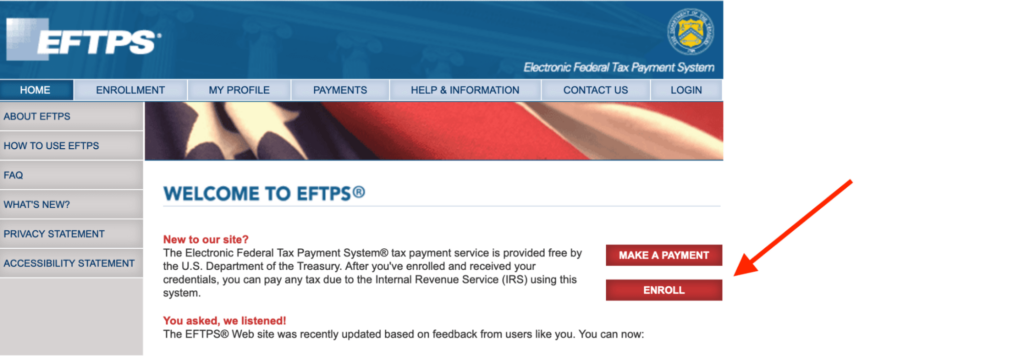

1. Go to the official website of The Electronic Federal Tax Payment System® – https://www.eftps.gov, click “ENROLL”.

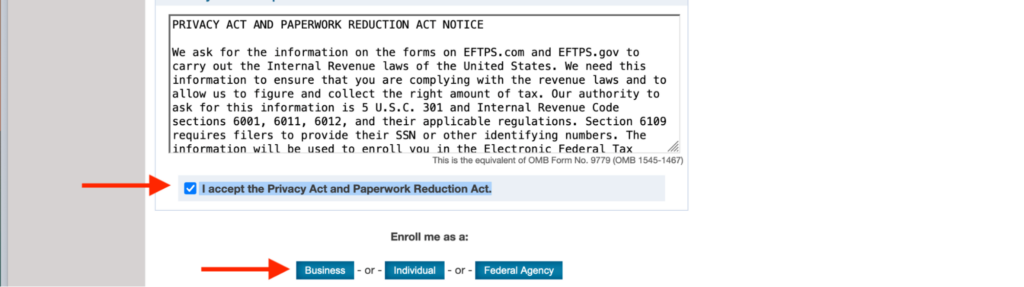

2. Click “I accept the Privacy Act and Paperwork Reduction Act” and click “BUSINESS”.

3. Fill in the application:

- Business Information

- Contact Information

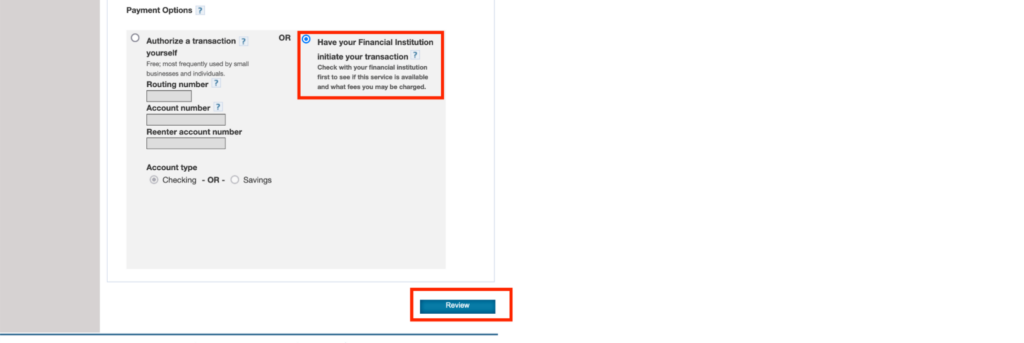

- Financial information – Choose “Have your Financial Institution initiate your transaction”

And then click “REVIEW”.

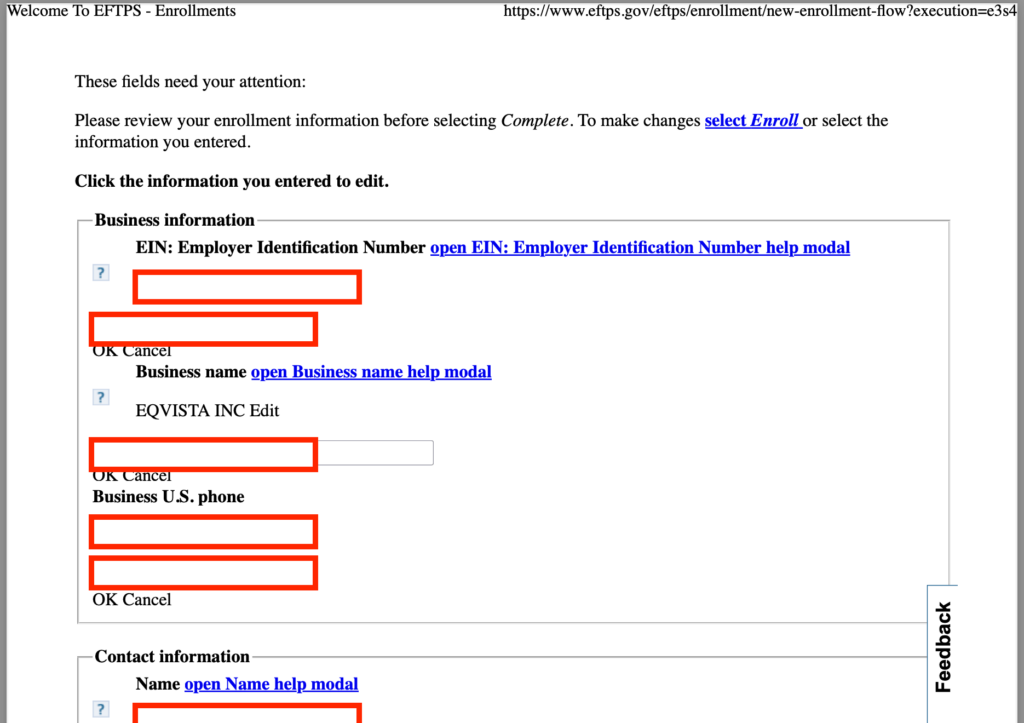

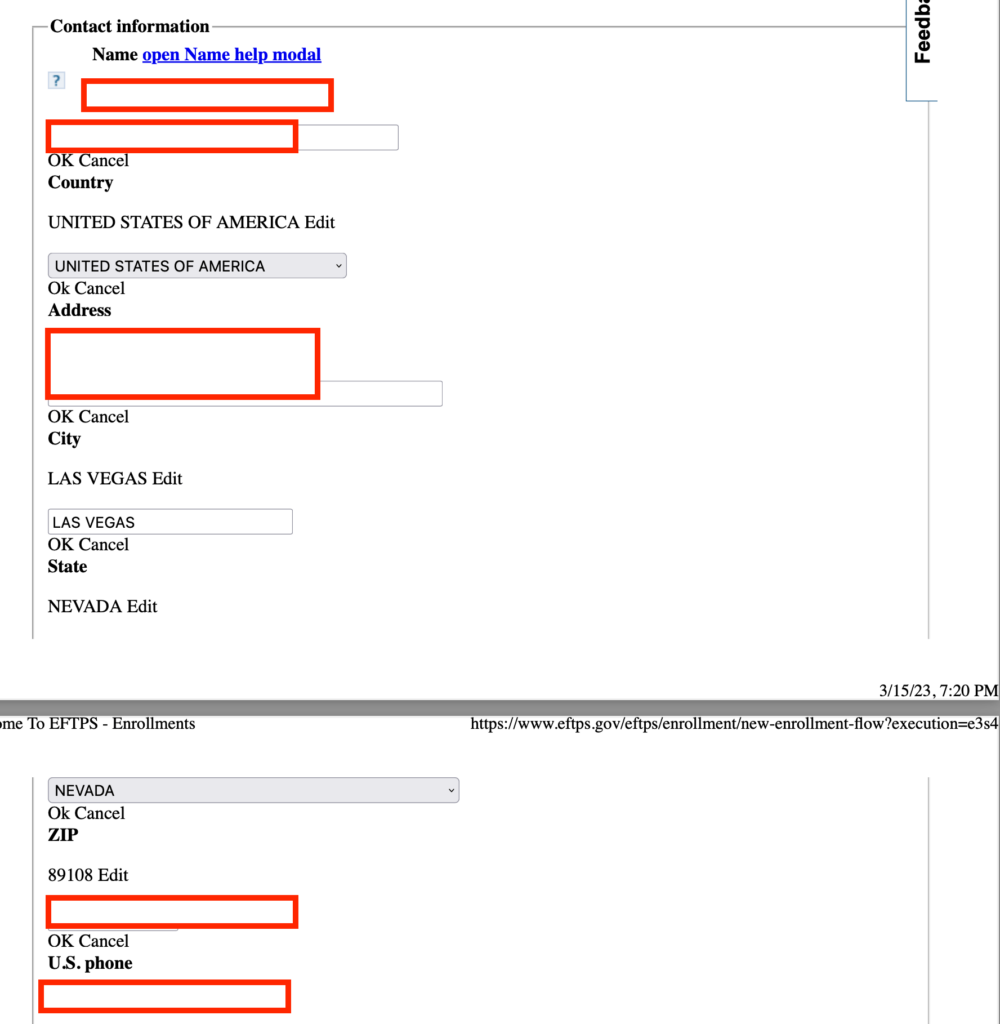

4. (APPLICATION) Press Command/CTR+P and save the Enrollment page in PDF to see the EIN clearly. This is the first document, which serves as proof of EIN – example here:

The contact information also needs to be visible:

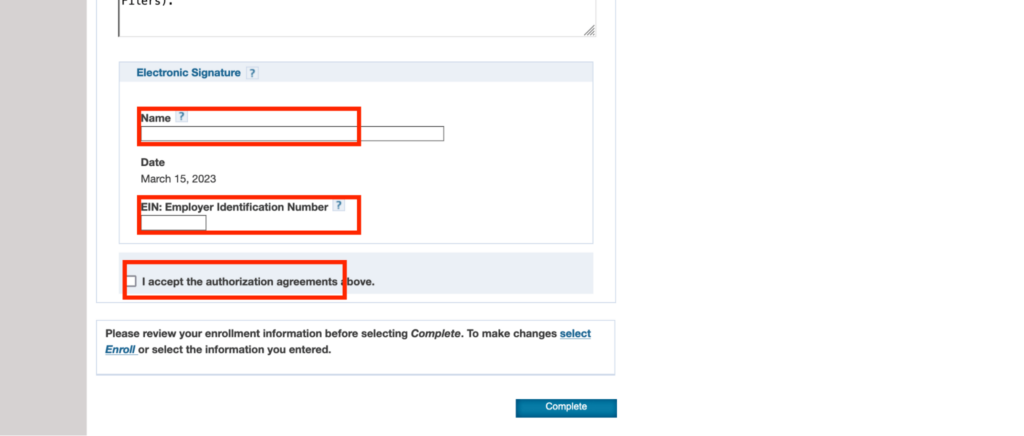

5. Fill in your name and EIN again, and press “Complete”.

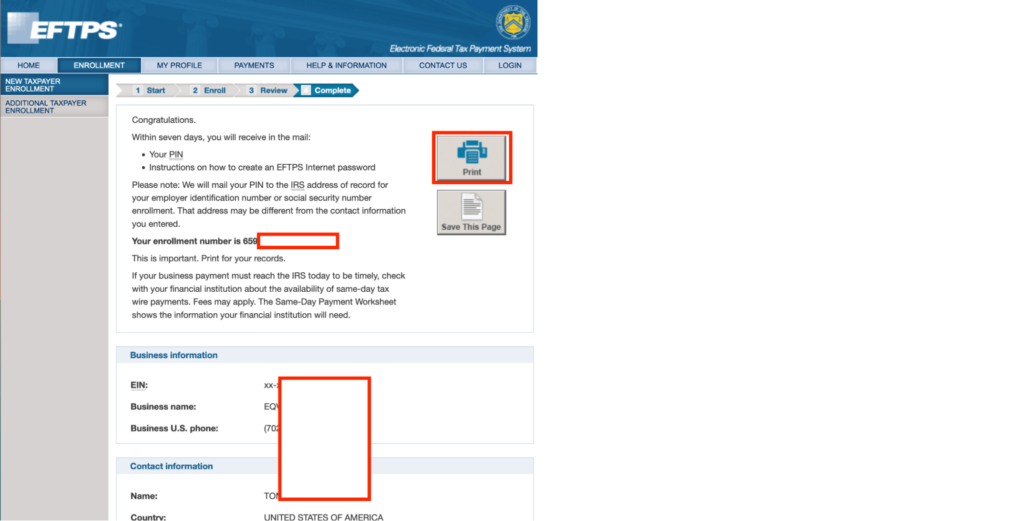

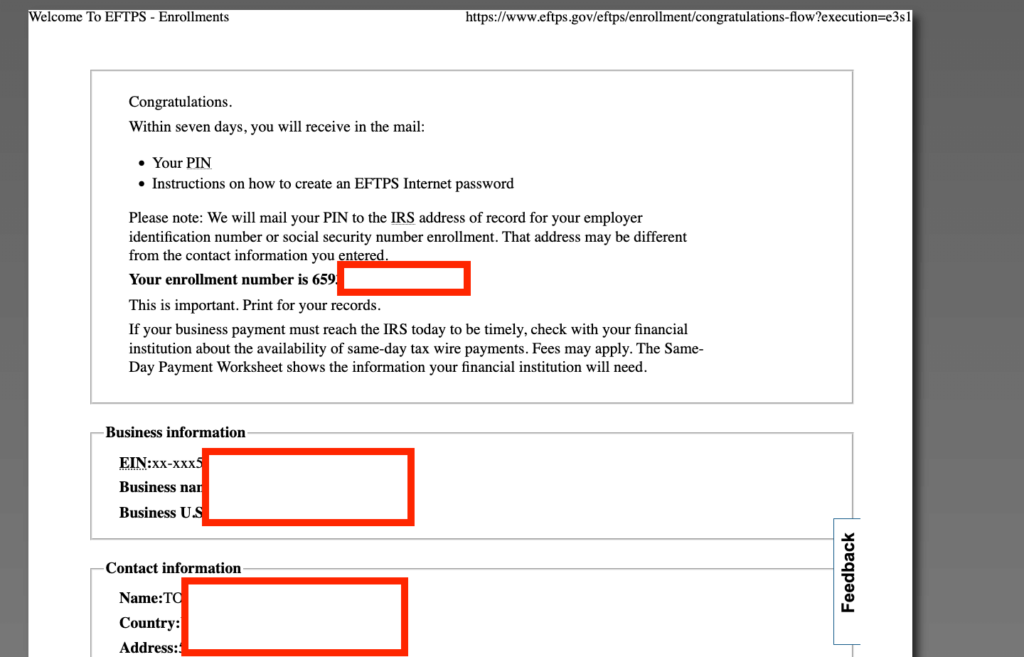

6. (CONFIRMATION) Press PRINT, choose “Print all” and save as PDF.

And you will get a confirmation document – This is the second document, which serves as proof of EIN – example here:

Now you already know how to get both documents that act as proof of EIN (Application & Confirmation), which you can use when creating an account with Cheqly – For the compliance team you will have:

- Filled Application in PDF (point 4)

- Confirmation document in PDF (point 6)