In today’s business landscape, accurate and timely company valuation is more critical than ever—especially for startups and private equity investors seeking a competitive edge. As a leading business incorporation specialist, IncParadise is committed to supporting entrepreneurs beyond company formation, connecting them with innovative solutions that drive smarter decision-making. That’s why we’re excited to spotlight Eqvista Real-Time Company Valuation®– a tool transforming how private companies and investors assess business value and make strategic moves.

IncParadise, a trusted partner of Eqvista, supports businesses by facilitating incorporation, providing registered agent services in all states, and helping set up business accounts. Thus, we help you get your business up and running in no time!

What is Eqvista’s real-time company valuation software?

Eqvista’s software delivers instant, data-driven valuations, empowering founders, investors, and advisors to access real-time insights without the long processing time of traditional valuation processes. It can be used for tracking company performance, establishing pre-money valuations in funding rounds, and enabling investors to pursue secondary market transactions in an informed manner.

The insights produced by this software can help you confidently navigate a wide range of challenging scenarios.

How does Eqvista’s company valuation software work?

Eqvista’s real-time valuation software was developed by valuation experts and seasoned tax accountants. The valuation data and models have been trained with over $100 billion worth in assets, spanning from simple asset valuations to highly complex portfolio funds. This software lets you learn your company’s fair market value (FMV) in seconds.

Unlock real-time insights for smarter decisions. Let’s onboard your company to Eqvista Real-Time Company Valuation®.

Advantages of Eqvista’s valuation software

This powerful and flexible real-time valuation software offers four key advantages, which are as follows:

- Instant valuations – Even for seasoned professionals, completing a valuation requires at least 30-40 hours of work. While professionals are trained to produce accurate valuations and insights under a wide range of scenarios, they cannot produce results instantaneously.

- Cost-efficiency – An in-depth valuation by professionals would cover various details and offer customization. Such valuations may cost thousands and cannot be relied upon if frequent valuations are needed.

- NACVA-certified valuations – Developed under the guidance of a NACVA-certified valuation analyst, Eqvista’s real-time valuation software delivers reports that not only meet all industry and legal standards but also provide exceptionally accurate, actionable, and defensible insights.

- Liquidity – Eqvista’s valuation reports can help reduce the ambiguity surrounding your startup’s valuation. By simply publishing your company’s FMV, you can enable all stakeholders to make informed decisions when approached with offers for their equity. Thus, you can facilitate some much-needed liquidity for your investors.

Use cases for Eqvista’s company valuation software

The real-time valuation software is meant to calculate fair market values (FMVs) objectively and efficiently, in line with prevailing market conditions. Since the software offers considerable flexibility, it touches on the most crucial points for a company, being:

Tracking performance

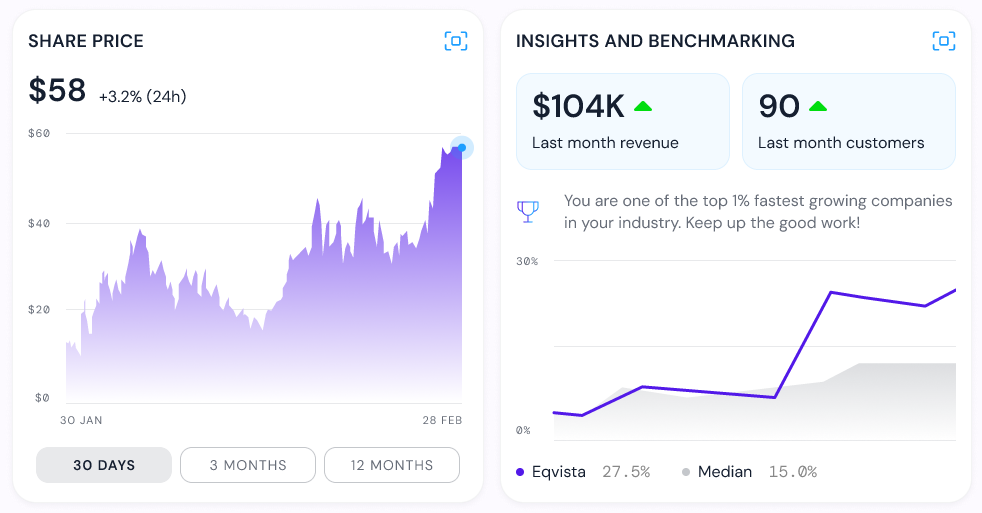

As conditions change, you can get an updated valuation on Eqvista’s valuation software. Then, you can refer to your valuation history to understand your company’s performance and market perception in changing industry and macroeconomic conditions. This is valuable for private companies without quoted stock prices, making it difficult to determine the impact of market changes on valuation.

Funding rounds

Real-time valuation software lets startups set a baseline valuation for funding negotiations. If funding rounds extend for a prolonged period and certain material events occur, founders can rely on the valuation software to update their expectations.

Thus, the valuation software can help founders avoid over-dilution while keeping their expectations grounded in reality. This ensures that founders do not pass on favorable funding due to overambitious valuation expectations.

Mergers and acquisitions (M&A)

In mergers and acquisitions (M&A), a startup must carefully review the offers received and make quick decisions. When you are considering an acquisition, due diligence often reveals critical information that the target company may have omitted, intentionally or not. The software enables you to swiftly and accurately update your valuation estimates based on new discoveries.

When you are expanding through acquisitions, you can use this software to monitor the value of your companies. Such valuations can also help you comply with extensive regulatory reporting requirements for companies going through M&As.

Long-term vision of building a global private equity ecosystem

In 2024, despite global private equity assets under management (AUM) reaching $270 billion, total exits leveled at only around $392.48 billion. Stagnant deal flow and lack of market intelligence have made it significantly difficult to exit investments, further discouraging new entrants. Consequently, the private equity market suffers from a low exit rate of 1.78%.

Investors lack a standardized system to evaluate the performance of portfolio companies and fund managers. This barrier to entry also leads to slow decision-making. Eqvista aims to eliminate the lack of information in the private equity market by providing real-time valuations.

Eqvista is valuing about $5 billion in client assets every month and is on track to reach $1 trillion in total assets by 2030. The culmination of this vision would signify valuable strides in investor empowerment and improvement of liquidity in private equity.

Eqvista – Where precision meets velocity!

IncParadise has partnered with Eqvista to provide comprehensive support to entrepreneurs, from conception to compliance. Together, we simplify governance, compensation, valuations, and tax compliance, unshackling entrepreneurs to pursue their vision without hindrances and distractions.

Eqvista’s real-time valuation software enables it to lead funding negotiations with clarity, ensure compliance with Section 409A, and track performance. Whether you are assessing inorganic growth opportunities or preparing financial reports, Eqvista delivers accuracy with velocity.

A private equity investor can leverage this software to track portfolio performance and evaluate investment opportunities. Contact Eqvista today to start expediting your valuations!