Digital documents are part of management in the modern age of digitalization. The development from physical documents to digital record-keeping has changed how we view ownership. Stock ownership is one of the most obvious transitions that has taken place.

Physical stock certificates have great historical significance. However, owning a stake in a company through shares has become easier with the introduction of uncertificated shares. The uncertificated and electronic shares are the current standards of the modern landscape.

Understanding these different forms of shares is exceptionally crucial for investors. They may not familiarize themselves well enough with the shares and commit mistakes in compliance, causing legal implications and penalties. If you are an investor, you should follow the industry standards to learn how ownership, transfer, and management of ownership are carried out. This article is a perfect guide to gain detailed information about stock certificates, electronic shares, and their key differences. By the end of this article, you will have complete knowledge of the drawbacks of physical certificates and the benefits of digital shares for investors.

Stepping Back in Time: Understanding Stock Certificates

What are uncertificated shares?

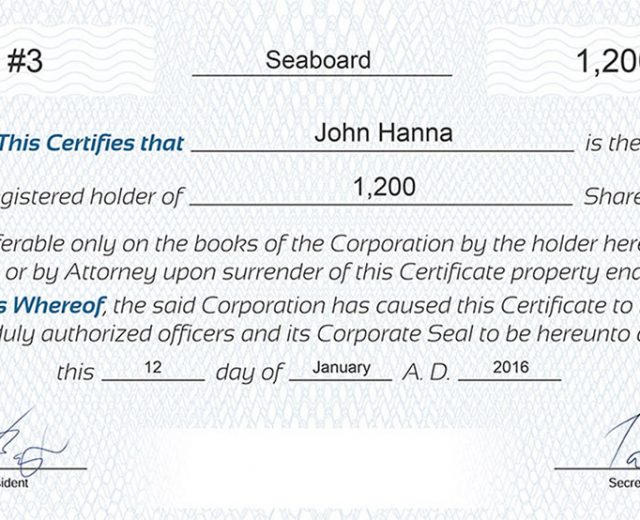

When we think of a stock certificate, we can say that it is the original way to prove you own a piece of a company. It is a genuine, tangible, and legally binding document used to demonstrate ownership of a stock. A stock certificate is a formal document that serves as tangible proof of ownership of shares in a company. In the past, these certificates were the only way to prove to own a stock in a company. Stock certificates are not just an ordinary piece of paper. These certificates feature elaborate designs and are adorned with intricate details, official seals, and signatures. They carry important details of the shareholders, like names, the number of shares each shareholder has, and the company’s details.

Signed, Sealed, Delivered: The Classic Process of Transferring Physical Shares

The process of buying, selling, and transferring shares using these physical certificates was carried out through a transfer agent. The buyer used to contact the broker to buy a stock. The stockbroker would then send a confirmation slip, and after the payment was made, the company would issue a physical share certificate in the buyer’s name. Sharing a physical certificate involved similar initial steps. However, the crucial step was to endorse the certificate to transfer the ownership physically. Endorsing a share certificate means signing the back of the document in a designated section. All these things were carried out by a transfer agent who played a crucial role in keeping everything official.

The pros and cons of physical stock certificates

The good old days of physical share certificates provided some investors a sense of direct control and security. Having a physical certificate gives the feeling of having something concrete and a stronger sense of direct control for investors. However, physical certificates came with significant drawbacks. The real risk of loss, theft, and damage to the certificates may impact the investors’ investment. The paper system and the procedural manual process of purchasing, selling, and transferring shares are laborious and prone to errors. Although the use of digital shares has increased, the market is yet to do without physical share certificates. They are still in existence and are applied in some situations.

Understanding the Role and Handling of Physical Share Certificates Today

Some common scenarios where share certificates may be encountered are when older holdings haven’t been converted, or smaller or older companies continue to issue them. They also exist in cases where certificates hold sentimental or collector’s value. If someone wants to trade shares held in paper form easily, they usually need to deposit the certificate with a broker. They will encode the physical certificates with electronic (uncertificated) shares that can be used to transfer shares.

The Digital Transformation: Embracing Electronic Shares

Electronic shares are the standard today, where ownership is recorded digitally and not on paper. Although physical shares exist today, they are not needed for stock transactions in current times. The main type of electronic share is called an uncertificated share or a book-entry share. This simply means there is no physical certificate, and the ownership is securely tracked online by your broker and central institutions known as securities depositories (SDRs).

Stock ownership seamlessly fits into our modern digital lives with the help of uncertificated shares. Buying and selling these digital shares has become very easy and fast through online brokerage platforms. These platforms enable investors to buy and sell stock from anywhere at any time, a sharp contrast from the archaic paper-based system.

Digital stock systems offer investors several advantages for transferring shares. These include faster transaction speeds with real-time trading and settlement, enhanced security by removing the risks of physical certificates like loss or theft, and cost savings from eliminating printing, storage, and manual handling. Investors can also easily manage their portfolios online. However, the system’s effectiveness depends heavily on strong cybersecurity measures.

Secure technology guarantees that the sensitive financial details are secure, a necessary element to put confidence in investors. People who trade in the stock market are required to have strong security online. It is the responsibility of all parties involved in the transaction to ensure the integrity and security of electronic records.

Key Differences between Stock Certificates and Uncertificated Shares

The Digital Foundation: What’s Next for Shareholding?

We have smoothly transitioned from tangible paper stock certificates to the efficiency of digital electronic shares. Paper stock certificates continue to be used, but digital stocks have made trading easy. Investors can always invest and keep track of their investments via online brokerage platforms.

This shift has offered a wide variety of advantages to investors. Using electronic shares increases the accuracy of the stocks and makes the transaction quick and easy. Furthermore, online platforms integrate strong cybersecurity measures to protect investors’ sensitive financial data. This enhances the security of the stocks and makes management easier.

Monitoring digital stocks is easier and quicker than monitoring paper stocks. Electronic shares are a cost-effective alternative to physical stock certificates. The printing and management costs of physical stocks are eliminated with the use of digital shares. Uncertificated shares provide easy access to the market and improve the stock market landscape for investors.

As technology advances, we can anticipate further innovations in how ownership is recorded and managed. Blockchain technology and other emerging solutions can further streamline and secure the process. As we move forward in the digital landscape, the need for uncertificated shares is expected to grow even larger than it is now.

Are You Ready to Issue Electronic Shares? We Have Partnered with Eqvista to Assist You.

Electronic shares can help a lot in managing your company’s equity. You can trust Eqvista if you are looking for a reliable partner for equity management. It provides an all-inclusive platform that enables businesses to issue and transfer shares electronically. You can keep an updated cap table and meet the compliance requirements of the regulation.

Their services are aimed at being user-friendly and convenient for companies of all sizes. Also, Eqvista and IncParadise’s collaboration may be beneficial for you. You can control your business and your shares by using Eqvista and IncParadise. Their network supports you in establishing and managing your business structure, which means you will not have a hitch in your transition to digital shareholding.

To explore how Eqvista can assist you in issuing electronic shares and managing your company’s equity, visit their website at Eqvista. For incorporation services and additional support, learn more about IncParadise here.