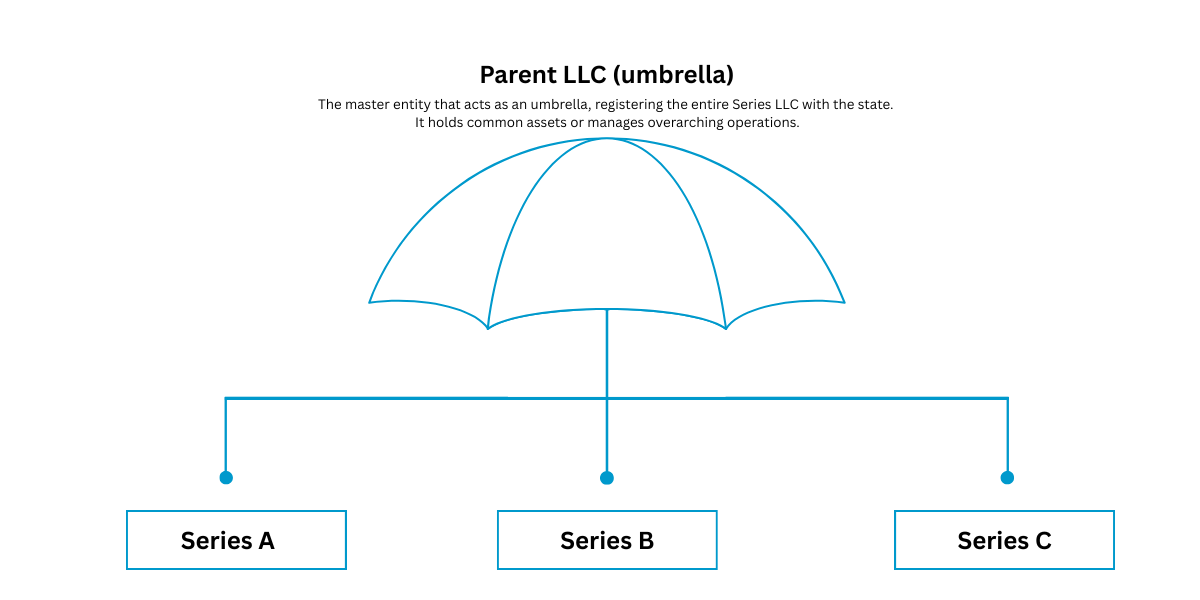

Imagine a single business structure that can house multiple ventures, each with its shielded assets and operations, all under one roof. That’s the power of a Series LLC. This innovative form of Limited Liability Company acts as a central “umbrella,” containing distinct “series” or “cells.” Within each series, you can have separate owners, assets, and management, allowing each venture to operate independently while enjoying protection from legal claims against the others.

Originating in Delaware, the model is rapidly gaining traction and is now available in a growing number of states across the United States, offering a compelling solution for entrepreneurs seeking to simplify and safeguard their diverse business interests.

What is the purpose of a Series LLC?

The series LLC (SLLC) includes the master or umbrella LLC and other LLCs that are separated from each other for liability purposes. It’s a form of a limited liability company that provides liability and legal protection across multiple “series” each of which is theoretically protected from liabilities arising from the other series. In the overall structure, the series LLC is described as a master LLC with separate divisions. The benefits of a Series LLC are that each LLC is still its own business, controlled by the master LLC. However, for legal and tax purposes, the Master LLC is held accountable for its other entities.

Benefits of Series LLC’s

A Series LLC offers numerous appealing benefits, making it an excellent choice for entrepreneurs managing multiple ventures. Below, we delve into these advantages in detail.

- Less Initial Start Up Cost: Only one filing fee is required, and an attorney or filing service such as Eastbiz.com – Incparadise, can set up the parent and cells at less cost than setting up multiple LLCs.

- Security of Assets: The assets of each series are generally protected from judgments against assets in other series, provided the Series LLC is properly maintained and state law is followed.

- Lower Sales Tax: Contingent on the regulations in your state, the dues paid from one entity to another entity in the series might not be subject to sales tax. It’s important to refer to your state’s tax laws on this point.

- Administrative Freedom/Less Administration: You can set up as many series as needed under the master LLC, each with its own assets and operations. This structure can potentially save on administrative time and cost compared to forming multiple separate LLCs.

- Less Complex than Corporation: A series LLC doesn’t have the same tax complication/ obligations, structure, or formalities (corporate records, for example) as a corporation.

- Only One State Registration: In many states, only the master LLC must be registered, which can reduce legal and registration fees. However, some states may require additional filings or fees for each series, so it is important to check your state’s requirements.

- Tax Filing: The tax filing requirements can vary. In some cases, the master LLC may file a single tax return, but the IRS may require each series to be treated as a separate entity for federal tax purposes. Some states also require separate tax filings for each series. Because this can be complex, it is important to consult a knowledgeable tax professional.

Potential Challenges of Series LLC’s

While offering significant advantages, the structure also comes with potential challenges that businesses should consider.

- Registered Agent Requirement: In most states, only the master LLC is required to have a registered agent. However, some states may have additional requirements, so it is important to verify the rules in your jurisdiction.

- Banking: Each series should have its own bank account and maintain separate accounting records to preserve liability protection. Managing multiple series can increase administrative complexity.

- Registration/ Formation Pricing: The cost of forming a series LLC may be higher than the cost of creating a regular LLC.

- Bankruptcy: Since the Series LLC concept is relatively new, there is still legal uncertainty about how individual series will be treated in bankruptcy proceedings. It is not fully settled whether bankruptcy courts will always recognize the separateness of different series within a Series LLC.

Your Next Steps with Series LLC Formation and Support

As you can see, there are many potential advantages to using a Series LLC, especially in high-risk industries such as construction, real estate, or franchise organizations for financial planning and liability purposes. However, it is important to understand that this is still a relatively new and evolving business structure, and legal treatment may vary by state.

For more information on series LLCs, the different LLC types, or assistance with filing for your new business, please feel free to contact Incparadise. We offer many services to help assist you with setting up your new business.

Disclaimer: The purpose of this article is to provide general information about a business entity. This author is not promoting the Series LLC and no tax or legal advice is being given in this article. If you are considering a Series LLC and your state has this entity available, talk to your tax and legal advisors before you take any action.